Transaction Advisory Services Things To Know Before You Buy

Table of ContentsAbout Transaction Advisory ServicesThe Single Strategy To Use For Transaction Advisory ServicesLittle Known Questions About Transaction Advisory Services.Rumored Buzz on Transaction Advisory ServicesFascination About Transaction Advisory Services

This action makes certain the service looks its finest to prospective customers. Getting the service's worth right is vital for an effective sale.Transaction consultants step in to assist by getting all the needed info organized, answering concerns from buyers, and preparing visits to the organization's place. This constructs trust fund with customers and maintains the sale relocating along. Obtaining the most effective terms is key. Deal experts use their competence to help local business owner deal with difficult settlements, satisfy buyer expectations, and framework deals that match the proprietor's goals.

Meeting legal rules is crucial in any kind of company sale. They help business proprietors in intending for their next actions, whether it's retirement, beginning a new venture, or handling their newly found riches.

Transaction consultants bring a wide range of experience and understanding, making certain that every aspect of the sale is dealt with expertly. Via critical preparation, evaluation, and arrangement, TAS aids entrepreneur attain the greatest feasible price. By ensuring legal and regulatory compliance and handling due persistance together with other bargain staff member, purchase advisors minimize possible risks and responsibilities.

Unknown Facts About Transaction Advisory Services

By comparison, Large 4 TS teams: Deal with (e.g., when a possible purchaser is performing due persistance, or when an offer is shutting and the customer requires to integrate the business and re-value the vendor's Annual report). Are with charges that are not linked to the bargain shutting successfully. Make charges per involvement someplace in the, which is less than what investment financial institutions make also on "little offers" (yet the collection likelihood is additionally a lot higher).

The interview questions are really similar to financial investment banking interview concerns, however they'll focus a lot more on bookkeeping and evaluation and less on subjects like LBO modeling. Anticipate inquiries regarding what the Change in Working Resources ways, EBIT vs. EBITDA vs. Earnings, and "accounting professional just" subjects like test balances and exactly how to go through occasions using debits and credit histories instead than monetary declaration changes.

The Only Guide for Transaction Advisory Services

that show how both metrics have transformed based on items, networks, and customers. to evaluate the precision of administration's previous forecasts., including aging, stock by product, ordinary degrees, and arrangements. to identify whether they're completely fictional or rather believable. Experts in the TS/ FDD groups may likewise talk click for source to management about whatever over, and they'll create a thorough report with their findings at the end of the procedure.

, and the general shape looks like this: The entry-level role, where you do a lot of information and economic evaluation (2 years for a promo from right here). The next level up; similar work, but you get the even more intriguing little bits (3 years for a promo).

Specifically, it's hard to obtain promoted past the Supervisor level because few individuals leave the work at that stage, and you need to begin revealing evidence of your ability to create earnings to breakthrough. Allow's start with the hours and lifestyle because those are simpler to explain:. There are occasional late nights and weekend break job, but absolutely nothing like the agitated nature of investment banking.

There are cost-of-living adjustments, so anticipate you can try this out lower settlement if you're in a more affordable location outside significant financial facilities. For all settings other than Partner, the base pay makes up the bulk of the overall compensation; the year-end incentive may be a max of 30% of your base pay. Commonly, the very best method to raise your profits is to switch over to a different firm and discuss for a greater salary and incentive

Transaction Advisory Services for Beginners

At this phase, you need to simply remain and make a run for a Partner-level function. If you want to leave, perhaps move to a client and execute their valuations and due persistance in-house.

The main trouble is that due to the fact that: You generally require to join about his an additional Big 4 group, such as audit, and job there for a few years and after that move into TS, job there for a couple of years and after that relocate into IB. And there's still no assurance of winning this IB function due to the fact that it depends on your region, customers, and the employing market at the time.

Longer-term, there is additionally some risk of and since assessing a company's historical financial information is not precisely brain surgery. Yes, people will constantly need to be entailed, yet with advanced modern technology, reduced headcounts can potentially sustain client engagements. That stated, the Transaction Providers group beats audit in regards to pay, work, and exit chances.

If you liked this short article, you may be curious about reading.

Transaction Advisory Services - An Overview

Create sophisticated financial structures that assist in figuring out the real market worth of a company. Give advising operate in relationship to organization valuation to assist in bargaining and pricing structures. Discuss the most suitable kind of the offer and the kind of consideration to utilize (money, stock, gain out, and others).

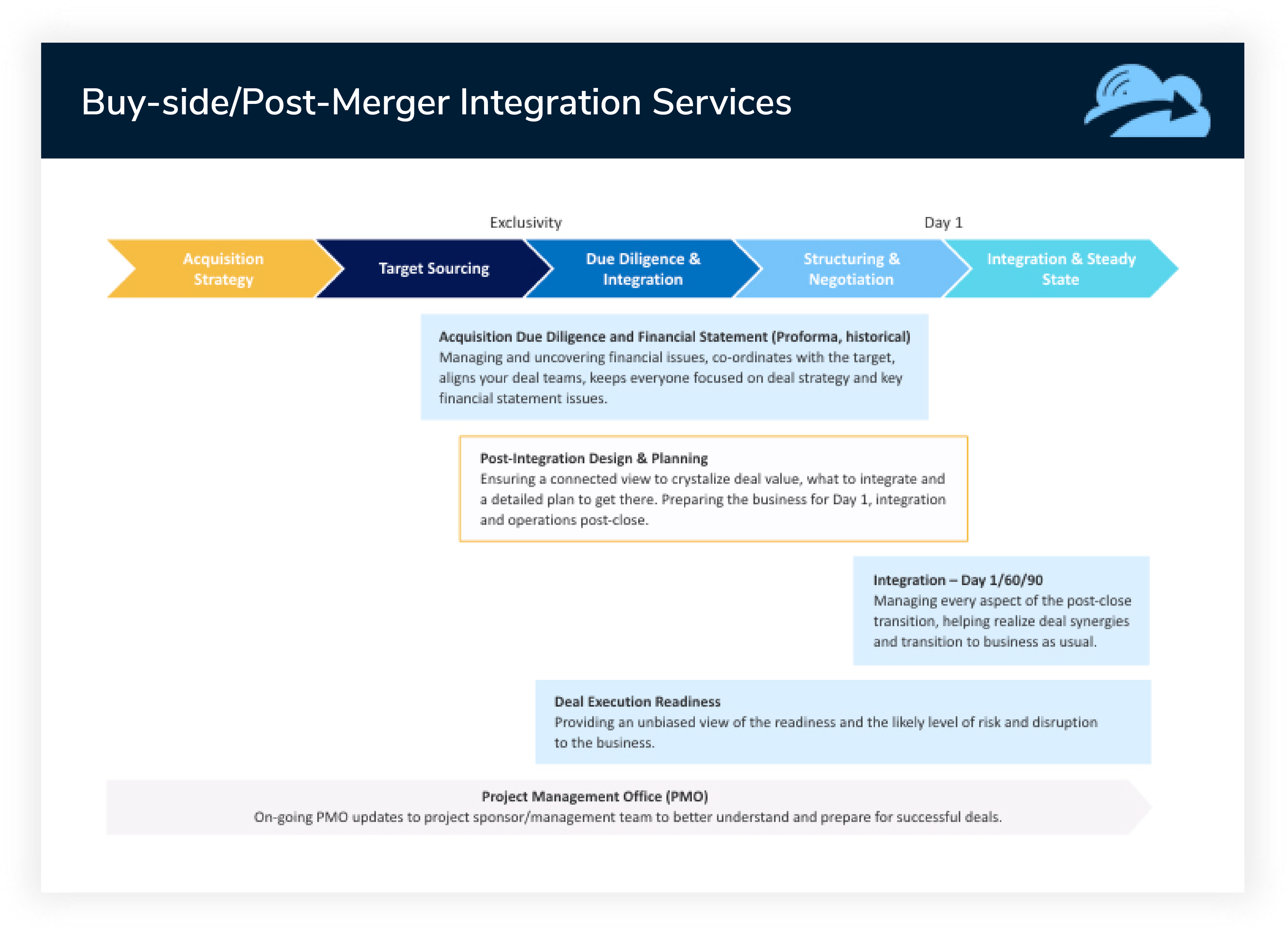

Carry out integration preparation to identify the procedure, system, and business changes that may be required after the offer. Set standards for integrating divisions, innovations, and business procedures.

Recognize possible reductions by minimizing DPO, DIO, and DSO. Analyze the possible customer base, market verticals, and sales cycle. Take into consideration the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The operational due diligence offers important understandings right into the functioning of the firm to be acquired worrying threat analysis and worth creation. Identify temporary alterations to finances, financial institutions, and systems.